New Home Purchase

When purchasing a new property/home, whether it's for personal use or investment, there are several important considerations that can help navigate the process smoothly.

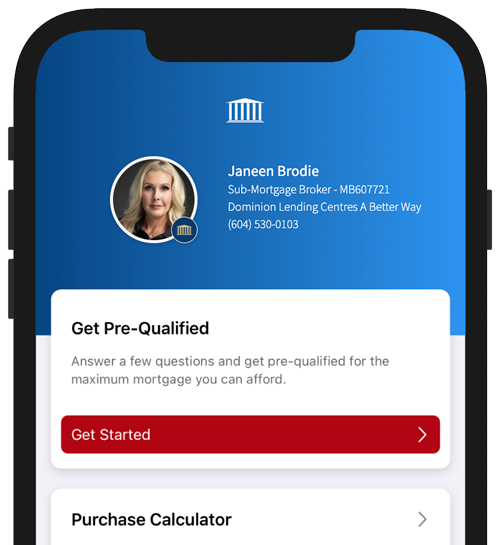

Financing and Affordability

Mortgage Pre-Approval: Securing a mortgage pre-approval helps you understand your budget and gives you a clearer picture of how much you can afford. This is a key step before making any offers.

Interest Rates: Fixed-rate mortgages provide stability, while variable-rate mortgages can offer lower rates, and less interest paid overall, but with the risk of rate fluctuations.

Down Payment: In Canada, the minimum down payment depends on the property’s price. For homes below $500,000, it’s at least 5%, but if the home is priced higher, the down payment can increase to as much as 20%.

Stress Test: Canadian mortgage lenders may require buyers to pass a mortgage stress test, which ensures they can handle mortgage payments even if interest rates rise.

Government Taxes and Fees

Land Transfer Tax: This is a tax paid when purchasing a home. Each province has its own rates, and some cities charge a municipal land transfer tax as well. First-time homebuyers may qualify for rebates on this tax in certain provinces.

Property Taxes: Property taxes vary depending on the city or municipality and are typically based on the value of the property.

Legal and Regulatory Considerations

Title Search: This is essential to ensure the property has no outstanding liens or disputes over ownership. A real estate lawyer typically conducts this as part of the closing process.

Zoning and Permits: If you plan to make renovations or changes to the property, you’ll need to ensure the property is zoned appropriately and that you can obtain the required permits from the municipality.

Condo Fees and Bylaws: If buying a condominium or townhouse, be aware of monthly condo fees and what they cover (e.g., maintenance, utilities). Review the building’s bylaws and financial health to avoid future complications.

Closing Costs

Legal Fees: Real estate lawyers are essential for the closing process, ensuring contracts are accurate, conducting title searches, and handling funds during the transaction. Legal fees typically range between $1,000 and $2,500.

Home Inspection: A home inspection is highly recommended to identify any potential structural or maintenance issues that could become costly down the road.

Insurance: Property insurance is required to secure a mortgage, and buyers may also want to consider title insurance to protect against any title disputes.

Understanding key factors such as financing, taxes, legal requirements, and closing costs is essential for a smooth transaction. Securing mortgage pre-approval and choosing the right interest rate can clarify your budget and help you manage future rate changes. Finally, budgeting for closing costs, including legal fees, inspections, and insurance, will help protect your investment and provide peace of mind throughout the buying process.