Resources and Forms

Here are a variety of common resources required by lenders that can help with you be pro-active in your purchase journey. Locating them will make the mortgage process more efficient.

Income

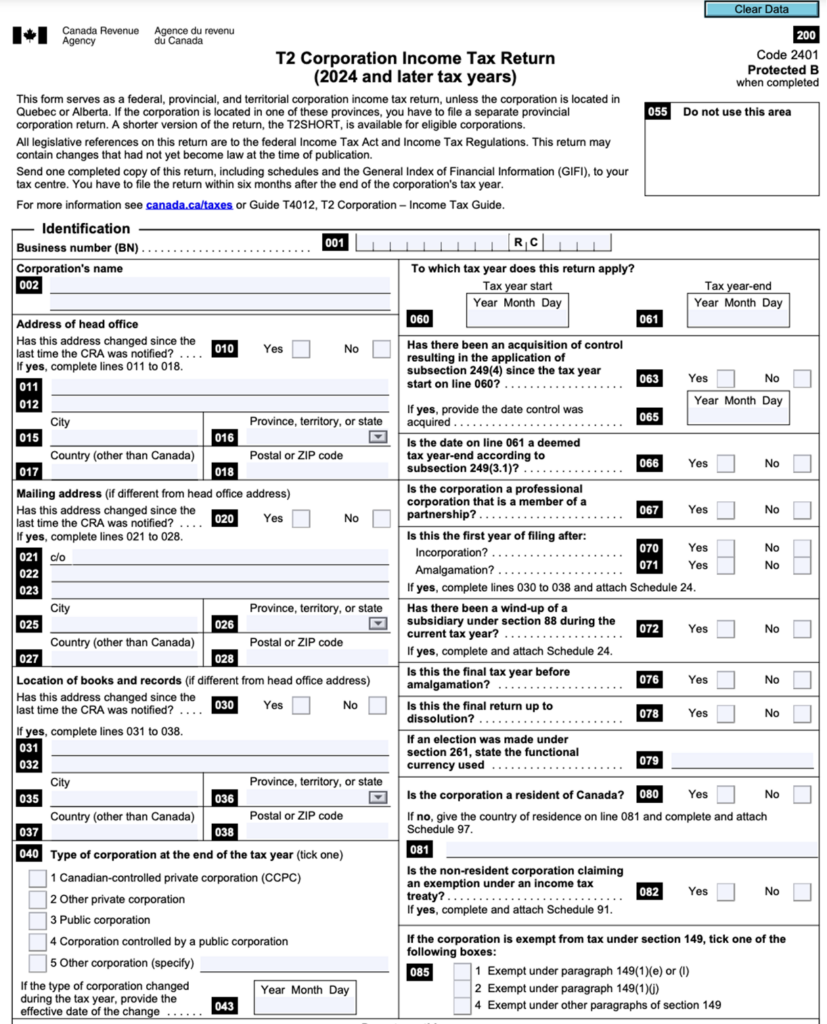

Corporate Tax Return (T2)

For self-employed individuals operating through a corporation, providing corporate tax returns can be an important part of the mortgage application process. Lenders will use corporate tax returns to verify the income from the business, especially if the borrower is a shareholder or draws dividends from the corporation. Here’s how corporate tax returns fit into the mortgage qualification process:

1. Corporate Tax Return (T2)

T2 Tax Return: If the self-employed borrower operates their business through a corporation, lenders may request the corporation’s T2 tax returns for the past 2-3 years. This allows lenders to understand the profitability and stability of the corporation.

Corporate tax returns show:

- Revenue and expenses of the corporation.

- Net profit or loss.

- Dividends paid to shareholders (including the borrower).

- Information about the company’s financial health, assets, and liabilities.

2. Dividends and/or Salary from Corporation

If the borrower draws a salary from the corporation, lenders will want to verify this income through personal tax returns (T1), along with the Notice of Assessment (NOA) to confirm that the income matches what is reported on personal tax filings.

If the borrower is paid dividends instead of (or in addition to) a salary, lenders will also look at:

- T5 slips (if dividends are issued) to verify dividend income.

- Any dividend income reported in the personal T1 returns.

3. Business Financial Statements

In addition to the corporate tax returns (T2), lenders may ask for business financial statements, which could include:

- Income statement (profit and loss) showing the business’s revenue and expenses.

- Balance sheet showing assets, liabilities, and shareholder equity.

- These are important to show the lender the financial standing of the corporation, especially if the borrower’s income is dependent on the corporation’s overall health.

4. Using Retained Earnings

Retained earnings in a corporation (profits that are kept in the business and not paid out as salary or dividends) can sometimes be used by lenders to help qualify for a mortgage. Some lenders consider retained earnings as an additional source of financial strength, especially for business owners who keep significant profits within the company.

5. Debt Service Ratios

Lenders will calculate the Gross Debt Service (GDS) and Total Debt Service (TDS) ratios, including the borrower’s personal debts and any debts of the corporation that they are personally responsible for (such as if they have personally guaranteed corporate loans).

6. Additional Considerations

Self-employed individuals with corporations may also face more stringent down payment requirements, with lenders sometimes requiring a higher down payment (20% or more) if they view the income as less stable or harder to verify.

Stated income mortgages may be an option for some corporate borrowers, where the income is not fully verified but a larger down payment is required.

Conclusion

When applying for a mortgage as a self-employed borrower with a corporation, providing clear, well-organized corporate tax returns (T2) along with business financial statements and your personal tax returns will help the lender assess your eligibility. The key is to show consistent and reliable income over the past few years, either through salary, dividends, or a combination of both.

Here is an example of a T2 Slip (Corporation Income Tax Return):

Letter of Employment

An employer letter is often required for a mortgage as part of the process to verify your income and employment stability. Lenders want to ensure that you have a steady and reliable source of income to make regular mortgage payments. Here’s why an employer letter is typically needed:

Income Verification: The letter confirms your current employment status, position, and salary, which helps the lender assess your ability to repay the loan.

Job Stability: Lenders prefer borrowers who have stable employment. The employer letter serves as proof that you are employed and likely to maintain your income level in the near future.

Documentation Requirement: Along with other financial documents (pay stubs, tax returns), an employer letter strengthens your application by providing a formal, signed statement from your employer.

Mitigating Risk: From the lender’s perspective, confirming your employment reduces the risk that you’ll default on the loan due to loss of income.

Different lenders may have different requirements, but this document is often a key part of the approval process for salaried or employed borrowers. If you’re self-employed, you may need to provide other documents, like business financials or tax returns.

An employer letter typically includes specific details about your employment and income to satisfy the lender’s requirements. Here’s a basic template and key elements that should be included:

[Company Letterhead]

Date: [Insert Date]

To Whom It May Concern,

This letter is to confirm that [Employee’s Full Name] is currently employed with [Company Name] as a [Job Title]. [He/She/They] has been employed with us since [Start Date].

[Employee’s Full Name] is employed on a [Full-time/Part-time/Contract] basis and earns an annual salary of $[Amount] (or an hourly rate of $[Amount] if applicable). Additionally, [he/she/they] receives bonuses or other compensation amounting to approximately $[Amount], if applicable.

We confirm that [Employee’s Full Name] is in good standing with the company, and there are no plans to terminate or reduce [his/her/their] employment in the foreseeable future.

Should you require any further information, please feel free to contact me at [Employer’s Contact Information].

Sincerely,

[Signature]

[Employer’s Full Name]

[Employer’s Job Title]

[Company Name]

[Company Address]

[Phone Number]

[Email Address]

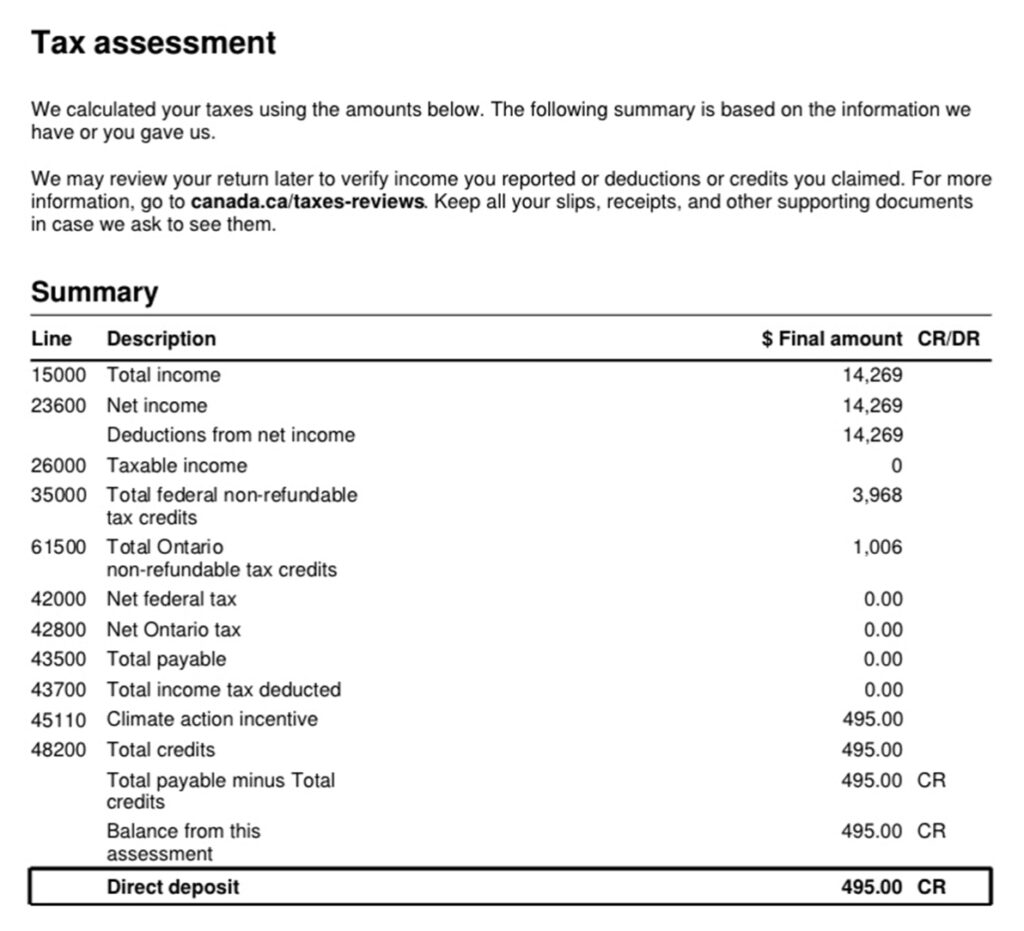

Notice of Assessment (NOA)

A CRA Notice of Assessment (NOA) is a vital document when applying for a mortgage. It provides a summary of an individual’s annual income and taxes, issued by the Canada Revenue Agency (CRA) after filing a tax return. Lenders request NOAs as part of mortgage applications to verify income and assess a borrower’s financial situation.

How a CRA NOA is used in Mortgage Applications:

Income Verification:

- The NOA reflects total income from all sources (employment, investments, self-employment, etc.).

- Lenders use it to verify the income claimed by the borrower in the mortgage application.

- Self-employed borrowers especially rely on NOAs, as they may not have regular pay stubs.

Debt and Tax Assessment:

If there are any taxes owing, this will be shown on the NOA. Lenders may view outstanding tax liabilities as additional debt, which can affect the borrower’s debt-to-income ratio and mortgage approval.

Consistency Over Time:

Lenders often ask for the last 2-3 years of NOAs to ensure that the borrower’s income is stable and consistent over time.

For self-employed borrowers or those with variable income (e.g., commissions, bonuses), this is critical to demonstrate steady earnings.

Proof of Payment:

If the borrower has tax arrears or any unpaid balances, lenders may want to see that taxes have been paid in full. The NOA helps confirm this.

How Many NOAs Are Required for Mortgages?

- Salaried Employees: Typically, 2 years of NOAs.

- Self-Employed or Commission-Based Employees: Lenders usually ask for 2-3 years of NOAs, along with additional documentation like T1 Generals or financial statements.

Key Role in Different Types of Mortgages:

Traditional Mortgages: Salaried or hourly employees may only need to provide recent NOAs if additional proof of income is required.

Self-Employed Mortgages: Lenders will typically place much more emphasis on NOAs to assess income stability since self-employed individuals might not have regular pay stubs.

Tips for Mortgage Applicants:

- Make sure all taxes are paid, as unpaid balances may affect your mortgage approval.

- Gather NOAs for the past 2-3 years in case the lender requests them.

- Working with a mortgage broker to better prepare your financial documents, as the application process might require additional proofs of income.

If you have any questions regarding this assessment, please contact the CRA at 1-800-959-8281.

Here is an example of a CRA Notice of Assessment (NOA):

- Total income for the year (line 15000)

- Taxable income (line 26000)

- Total tax assessed

- Total federal and provincial taxes paid

- Any balance owing or refund due

- The Total Income (Line 15000) and Taxable Income (Line 26000) are two critical figures that lenders look at to determine your ability to afford a mortgage.

- Any balance owing or refund also indicates whether taxes were correctly paid, which is important for financial health assessment during mortgage approval.

Self Employed

For self-employed individuals seeking a mortgage, lenders typically require more documentation than for salaried employees. Since self-employed income can be more variable and harder to verify, lenders want to see a solid financial track record to assess the borrower’s ability to repay the loan. Here’s a list of the typical business financials and documents that self-employed borrowers need to provide:

1. Personal Income Tax Returns (2-3 Years)

Notice of Assessments (NOA): Lenders generally ask for 2-3 years of personal tax returns and Notices of Assessment from the Canada Revenue Agency (CRA) to verify the borrower’s income and ensure there are no outstanding tax liabilities.

T1 Generals: The complete tax return (T1 General) that includes details of the borrower’s personal income and deductions.

2. Business Financial Statements (2-3 Years)

If the self-employed individual operates a corporation or partnership, lenders may ask for full business financial statements prepared by a professional accountant.

These should include:

Income statement (profit and loss): Shows the business’s income and expenses.

Balance sheet: Lists the business’s assets, liabilities, and equity.

3. Proof of Business Ownership

This may include:

Articles of incorporation (if incorporated).

Business registration documents (for sole proprietorships or partnerships).

4. Bank Statements

Lenders may request 3-6 months of business and personal bank statements to assess the cash flow of the business and verify consistency in income deposits.

5. Contracts or Invoices (Optional)

Some lenders may ask for contracts, invoices, or agreements with clients to prove ongoing work and future income.

6. Account Letter (Optional)

In some cases, lenders may ask for a letter from a certified accounts verifying the borrower’s income and business structure.

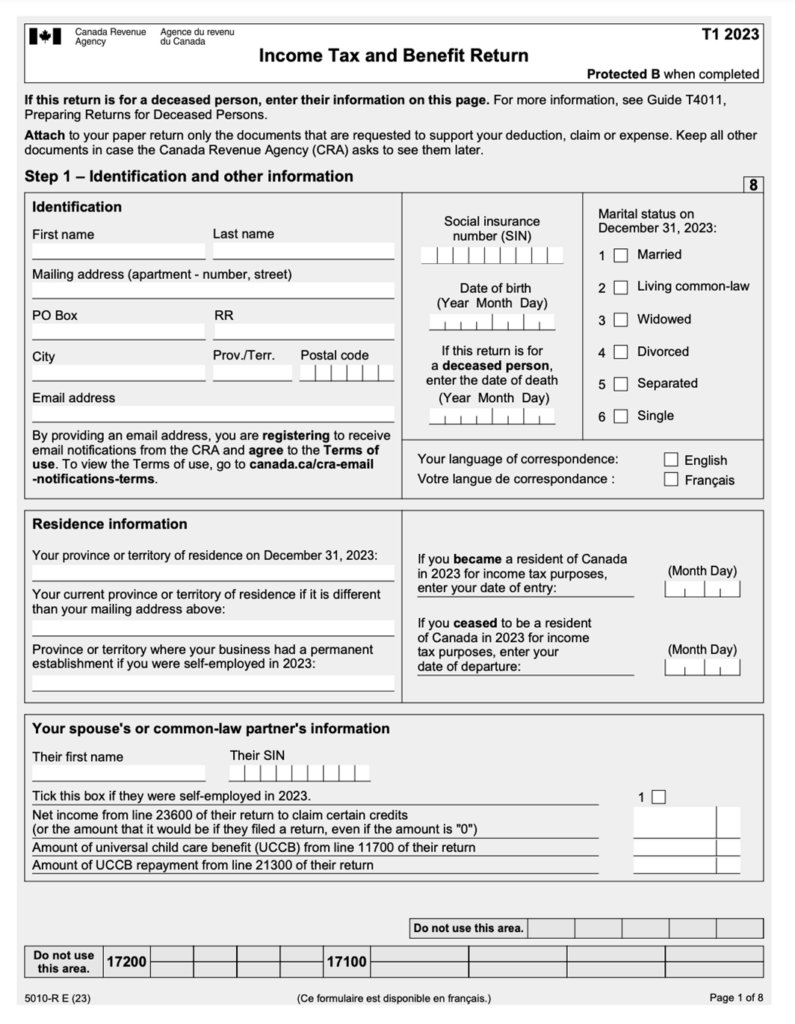

T1 and T2125

Mortgage lenders often require detailed financial documents like the T1 General and the Statement of Business Activities (T2125), especially for self-employed individuals. These documents help lenders assess a borrower’s income and financial stability. Below is an explanation of both forms and their role in the mortgage application process.

T1 General (Personal Income Tax Return Form)

The T1 General is a comprehensive tax return form that summarizes an individual’s income, deductions, and taxes owed or refunded. It’s an essential document for both salaried and self-employed individuals applying for mortgages.

Key Sections of the T1 General:

- Personal Information: Name, SIN, address, and filing status.

- Total Income (Line 15000): Includes income from all sources (employment, business income, capital gains, etc.).

- Net Income (Line 23600): Gross income minus deductions like RRSP contributions and union dues.

- Taxable Income (Line 26000): The amount of income on which taxes are calculated.

- Federal and Provincial Tax Deductions: Taxes paid or payable, and any refundable credits.

- Refund or Balance Owing: Whether you owe taxes or are due a refund.

Why Lenders Request T1 General for Mortgages:

Income Verification: Lenders use the T1 General to verify all sources of income, including self-employment and investments.

Deductions & Tax Obligations: It shows any deductions, outstanding taxes, or other liabilities, which may affect the mortgage qualification process.

Consistency Over Time: Lenders typically ask for 2-3 years of T1 Generals to assess whether your income is stable, particularly if you’re self-employed or have fluctuating income.

Here is an example of a T1 General (Personal Income Tax Return Form):

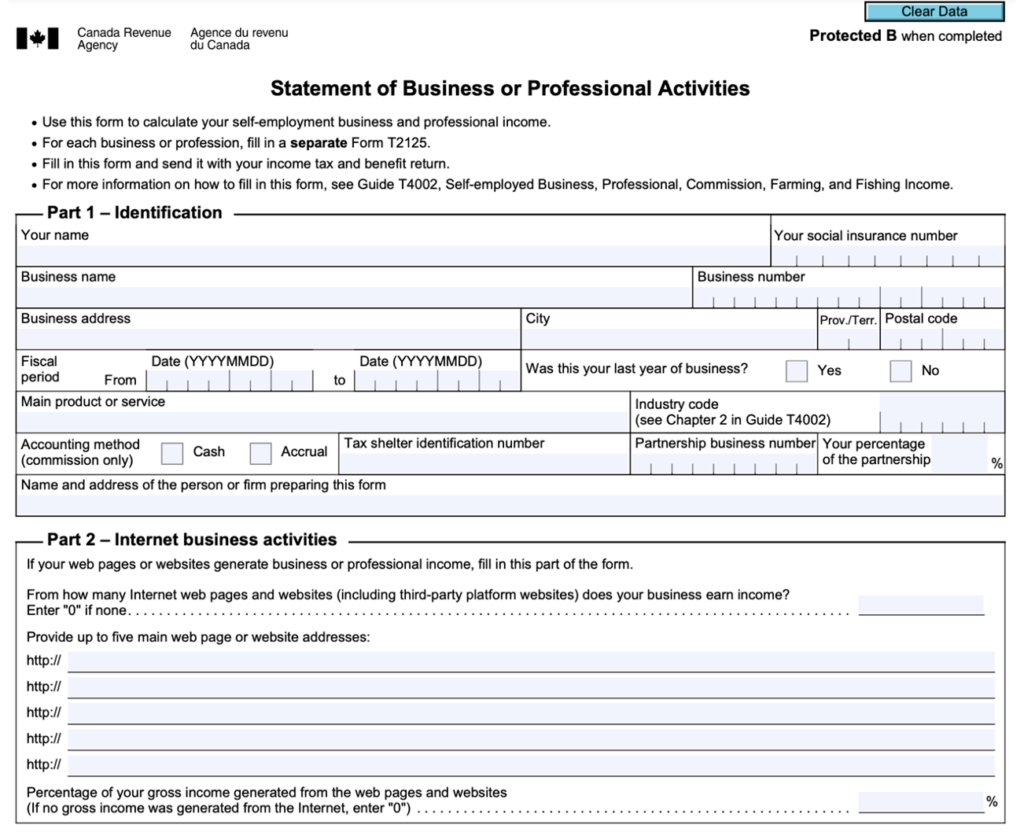

Statement of Business or Professional Activities (T2125)

The T2125 Statement of Business or Professional Activities is a key part of the tax filing process for self-employed individuals, freelancers, or those earning income through a small business. This form details the revenue and expenses related to running a business.

Key Sections of the T2125:

Business Information:

- Business Name and Address

- Business Code (industry-specific classification)

- Fiscal Period (the time period for which you are reporting income)

Income:

Gross Income: The total income generated from business or professional services.

Expenses: Categories like advertising, office supplies, rent, salaries, utilities, vehicle expenses, and capital cost allowance (depreciation of business assets).

Net Business Income: The gross income minus all allowable business expenses.

Net Profit/Loss: After deducting expenses from income, this line shows your business’s net income, which is reported on the T1 General as part of your total income.

Why Lenders Request T2125 for Mortgages:

Net Business Income: Lenders use the net business income to calculate your overall income and determine how much mortgage you can afford.

Expense Patterns: The form helps lenders understand your business’s financial stability and whether your income is sustainable, particularly for self-employed borrowers.

Consistency: Lenders typically want 2-3 years of T2125 forms to ensure your business income is stable or growing, which helps them assess the long-term viability of your earnings.

Here is an example of a Statement of Business Activities (T2125):

Mortgage Application Process for Self-Employed or Business Owners

If you’re self-employed, lenders often look at both the T1 General and the T2125 (Statement of Business Activities) to evaluate:

- Total Income: The lender will add up all sources of income (from employment, business, and other investments) shown on your T1 General.

- Business Viability: The T2125 provides insight into how well your business is doing and whether your business income can sustain a mortgage.

- Consistency: Having steady or increasing income over 2-3 years will improve your chances of mortgage approval.

Additional Documents for Self-Employed Mortgage Applicants:

- CRA Notice of Assessments (NOAs) for the last 2-3 years to verify that taxes have been paid.

- Business Financial Statements (if applicable) to provide more detailed insights into the financial health of the business.

- Bank Statements to show cash flow.

Tips for Self-Employed Borrowers:

- Maintain thorough and organized records of your business income and expenses.

- Be prepared to provide at least 2-3 years of both T1 General and T2125 documents, along with NOAs.

- Work with a mortgage broker, as they can help present your financials in the best light to lenders.

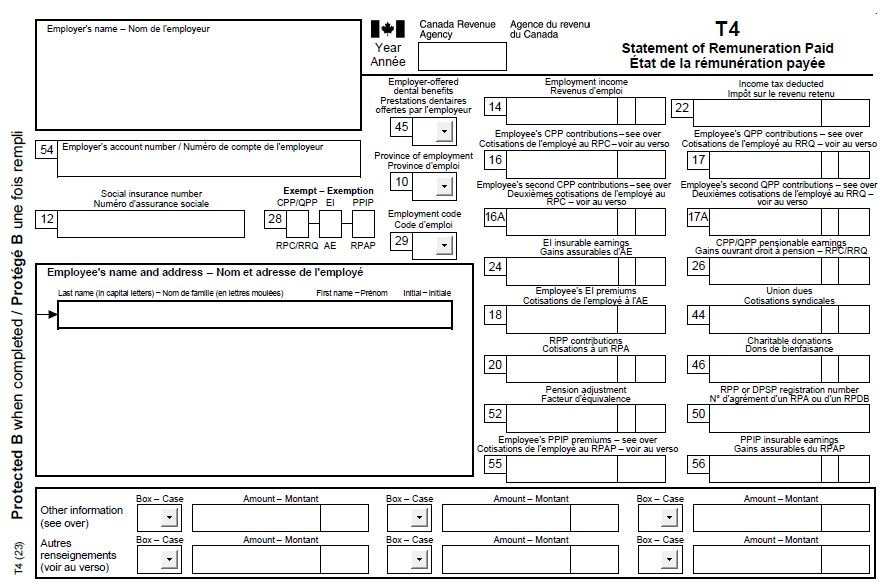

T4 and T4A

The T4 and T4A slips are common tax documents used to report different types of income to the Canada Revenue Agency (CRA). These forms are often requested by lenders during the mortgage application process to verify an applicant’s income and ensure they have a stable and reliable source of earnings. Here’s an overview of both forms and how they are used in mortgage applications:

T4 Slip (Statement of Remuneration Paid)

The T4 slip is issued by employers to employees and reports employment income, along with deductions made during the tax year. It’s the most common slip for salaried or hourly employees.

Key Sections on the T4 Slip:

- Employment Income (Box 14): Total income earned from the employer during the year.

- Income Tax Deducted (Box 22): The amount of federal and provincial tax withheld by the employer.

- Canada Pension Plan (CPP) Contributions (Box 16): The contributions deducted for CPP.

- Employment Insurance (EI) Premiums (Box 18): The amount deducted for EI premiums.

- Other Boxes: Deductions for union dues, RRSP contributions, taxable benefits, etc.

Why Lenders Request T4 Slips:

Income Verification: The T4 slip shows a summary of an applicant’s total employment income for the year, which is crucial for lenders to assess how much mortgage the applicant can afford.

Tax Deduction Verification: It verifies that income taxes and other mandatory contributions (like CPP and EI) have been properly deducted.

Employment Stability: A history of steady employment income from multiple T4 slips over 2-3 years can improve the likelihood of mortgage approval.

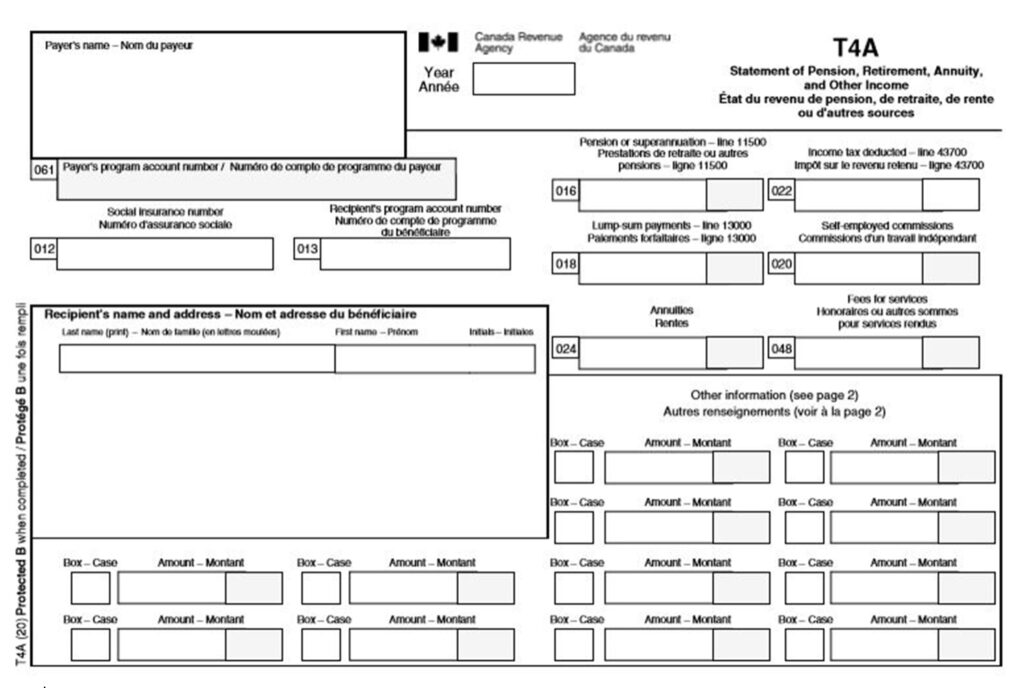

T4A Slip (Statement of Pension, Retirement, Annuity, and Other Income)

The T4A slip reports various types of income that are not considered regular employment income. It’s issued for pensions, self-employment income, commissions, scholarships, or other sources of income that aren’t covered by a traditional T4.

Key Sections on the T4A Slip:

- Box 020: Self-employed commissions.

- Box 028: Other income, including fees for services or freelance work.

- Box 016: Pension or retirement income.

- Box 105: Scholarships or bursaries.

- Box 048: Fees for services paid to self-employed individuals (e.g., contractors or consultants).

Why Lenders Request T4A Slips:

Verification of Non-Employment Income: If you receive income from freelance work, commissions, pensions, or other non-salary sources, the T4A shows the total amounts and helps lenders calculate your overall income.

Self-Employed Income: For self-employed borrowers or those who receive commissions, the T4A is crucial in providing evidence of their earnings. Lenders often request multiple years of T4A slips to ensure income stability.

Pension or Retirement Income: If the applicant is retired or nearing retirement, the T4A shows pension income, which is factored into mortgage affordability calculations.

Mortgage Application Process for T4 and T4A Holders

Salaried Employees (T4 Holders):

- Most lenders will request T4 slips from the past 1-2 years to verify income and job stability.

- CRA Notice of Assessment (NOA) is also commonly requested to confirm that the taxes on that income have been paid.

- If the applicant has consistent income and stable employment history, the T4 provides a solid basis for calculating mortgage affordability.

Self-Employed or Commission-Based Borrowers (T4A Holders):

- Lenders often require 2-3 years of T4A slips to confirm that the borrower has consistent income from their business, commissions, or contract work.

- Additional documents like T1 Generals, Statement of Business Activities (T2125), and NOAs may be required to provide a fuller picture of the borrower’s financial situation.

- Some lenders may also request bank statements or business financials to validate the cash flow and health of the business for self-employed applicants.

Tips for Applicants Using T4 and T4A Slips:

- Keep multiple years of both T4 and T4A slips handy, as lenders often request 2-3 years of documents.

- Ensure that all income reported on your mortgage application matches the income on your T4 and T4A slips.

- Be prepared to explain any fluctuations in income, particularly for commission or self-employed work, which can affect how lenders view your financial stability.

Here are examples a T4 Slip (Statement of Remuneration Paid) and T4A Slip (Statement of Pension, Retirement, Annuity, and Other Income):

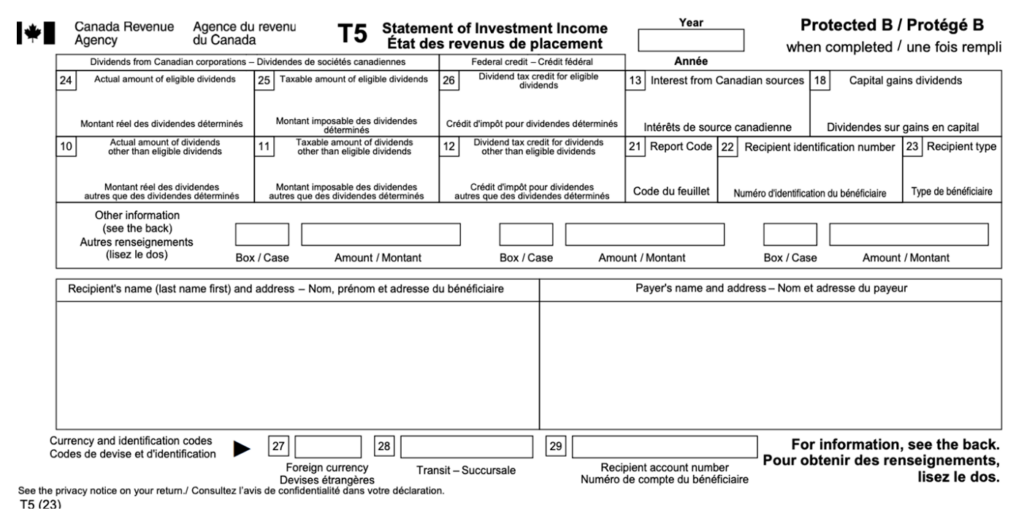

Use of Dividend Income (T5)

When using corporate dividend income to boost your personal income for a mortgage, there are a few key considerations lenders will take into account. Here’s how the process typically works:

1. Inclusion of Dividend Income as Personal Income

Corporate dividend income can be added to your personal income when applying for a mortgage, but lenders usually evaluate it differently from traditional salaried income. The dividend income must appear on your personal tax returns (T1 General), and lenders may review a two-year history of this income to ensure it’s consistent and sustainable.

2. Two-Year Average of Dividend Income

To add corporate dividend income to your personal income, most lenders require a two-year history of dividends being paid to you. They will average this income over the two years to provide a more reliable estimate of your annual income. This is done to smooth out any fluctuations in dividend amounts.

3. Grossing Up Dividend Income

Since dividends are taxed more favourably than salaried income, some lenders will “gross up” the dividend income by a percentage (often between 15% to 25%). This grossing up reflects the pre-tax equivalent of the dividend, thus increasing the amount of income lenders consider when determining your mortgage affordability. For example, if you receive $50,000 in dividends, and the lender uses a 20% gross-up, they will consider it as $60,000 for qualifying purposes.

4. Corporate Financial Health

Lenders may want to see corporate financial statements to verify that the corporation is generating sufficient profit to sustain the dividends. This is especially true for smaller businesses where your personal income is closely tied to the company’s performance.

5. Personal and Corporate Tax Returns

You’ll need to provide your personal tax returns (T1 Generals),Notices of Assessment (NOAs), and Statement of Investment Income (T5) from the Canada Revenue Agency (CRA) to show that you’ve declared the dividend income. Some lenders may also require corporate tax returns (T2) to review the company’s overall financial health.

6. Debt-Service Ratios (GDS and TDS)

Lenders will use the dividend income in the same way they use other income to calculate your Gross Debt Service (GDS) and Total Debt Service (TDS) ratios. The GDS ratio measures the percentage of your income that goes towards housing costs (like mortgage payments, property taxes, heating), and TDS measures the percentage of your income that goes towards all debt payments.

Example of How it Works:

- Dividend Income: Suppose you receive $50,000 annually from your corporation in dividends.

- Gross-Up: If the lender applies a 20% gross-up, they will treat it as $60,000.

- Mortgage Qualification: This increased income could help you qualify for a larger mortgage than if you only used your base income or salary.

7. Types of Lenders

A-Lenders (Major Banks): These lenders typically have more stringent rules when it comes to self-employed or dividend income. They’ll require consistent documentation and may scrutinize your corporate financials more closely.

B-Lenders (Alternative Lenders): B-lenders may be more flexible with dividend income, especially if your overall credit and financial profile are strong. They might accept a shorter income history or use a higher gross-up percentage.

8. Impact on Down Payment

If your corporate dividend income is substantial and stable, it can help you qualify for a higher mortgage and potentially reduce the size of your required down payment, though some lenders may still prefer a larger down payment for self-employed or dividend-based applicants.

Considerations:

- Dividend Fluctuation: Dividends can be more volatile than salaried income, which may raise concerns for the lender.

- Company Structure: If your business has retained earnings or is generating substantial profits, it will be easier to justify the continuation of dividend payments.

By combining corporate dividend income with any other personal income sources, you may be able to increase your purchasing power. However, each lender will have its own criteria, so it’s crucial to work with a mortgage broker who understands the requirements for self-employed individuals and those receiving dividend income.

Here is an example of a Statement of Investment Income (T5):

Rental Property

Rental Income

Rental income can be used to help qualify for a mortgage, but lenders have specific guidelines for how it is confirmed and calculated. Here’s a summary of how rental income is typically handled when applying for a mortgage:

1. Types of Rental Income

Existing Rental Income: This refers to income generated from properties already rented out, such as investment properties or units within your primary residence (like a duplex).

Prospective Rental Income: If you are buying a property that you plan to rent out, lenders may consider future rental income, but they typically apply more conservative estimates.

2. Documents Required to Confirm Rental Income

To confirm rental income, lenders usually require:

- Lease Agreements: For properties currently rented, a copy of the signed lease agreement is required.

- T1 General (Tax Returns): For rental income declared on your tax returns, lenders will usually ask for the last 2-3 years of tax returns to confirm consistency in the income.

- Notice of Assessment (NOA): This confirms your total income declared and accepted by the Canada Revenue Agency (CRA).

- Rental Statements: For larger rental portfolios, some lenders may ask for detailed rental statements outlining income, expenses, and net profits.

- Bank Statements: To verify rental payments are being deposited regularly into your account.

3. Calculating Rental Income for Mortgage Qualification

Lenders typically use one of the following methods to account for rental income:

Inclusion Method: The lender adds a percentage (often 50% to 80%) of the rental income to the borrower’s total income. The percentage varies by lender and whether the rental property is owner-occupied or strictly an investment property.

Offset Method: A percentage (usually 50% to 80%) of the rental income is used to offset the expenses (like mortgage payments, property taxes, insurance, etc.) associated with the rental property.

4. Rental Income for Investment Properties

Down Payment: Most lenders require a higher down payment for investment properties (typically 20% or more) compared to owner-occupied properties.

Debt Service Ratios: Lenders will use rental income to calculate debt service ratios (Gross Debt Service (GDS) and Total Debt Service (TDS)) to determine if you can afford the mortgage.

5. Vacancy and Maintenance Factor

Some lenders may apply a “vacancy and maintenance” factor to account for potential periods where the property is not rented. This could be 5% to 10% of the gross rental income, reducing the amount of rental income considered for mortgage qualification.

6. Rental Income from Short-Term Rentals

Rental income from short-term rentals (e.g., Airbnb) may be harder to use for mortgage qualification. Some lenders may not consider this type of income unless it’s well-documented over several years and shown on tax returns.

7. Rental Income and CMHC (Canada Mortgage and Housing Corporation)

CMHC, which insures high-ratio mortgages, has specific rules for using rental income. They allow rental income to be included in the borrower’s total income if it’s from a legal rental suite in their primary residence or a property purchased with the intention of renting it out. CMHC may also allow up to 100% of rental income if certain conditions are met, such as proven rental history and documentation.

Each lender may have slight variations in their approach to confirming and calculating rental income, so it’s essential to discuss this with your mortgage broker, so they can confirm the guidelines of the specific lender you’re working with.

Down Payment

Bank Statements

When applying for a mortgage, lenders require bank statements as part of the verification process for your down payment. This helps them ensure that the funds you’re using for the down payment are legitimate and meet regulatory requirements. Here’s a breakdown of how bank statements are used for mortgage down payment verification:

Why Lenders Request Bank Statements:

- Proof of Down Payment: Lenders need to verify that you have sufficient funds available for the down payment. A bank statement provides clear documentation of where the money is coming from and how long it has been in your account.

- Anti-Money Laundering (AML) Compliance: Under Canadian law, lenders must comply with anti-money laundering regulations, which require them to verify the source of your down payment. Large or sudden deposits may raise red flags, and the lender may ask for explanations or additional documentation for those funds.

- Debt-to-Income Ratio: Bank statements allow lenders to see your financial health, including your current debts, regular income, and spending patterns, helping them assess whether you can afford the mortgage payments.

What Lenders Look for in Bank Statements:

Consistency of Funds: Most lenders want to see at least 90 days (3 months) of bank statements to verify that the down payment funds have been in your account for a significant period. Large, recent deposits may need to be explained (e.g., gift from family, sale of an asset, etc.). These can be downloaded from your online banking portal.

Source of Funds: The bank statements should show the accumulation of savings from income or other legitimate sources. For a gifted down payment, lenders will often require both a gift letter and the bank statement showing the transfer. Each lender has their own gift letter and will provide a copy. If the funds come from selling an asset (e.g., a car or investment), proof of the sale may also be needed.

Sufficient Funds for Closing Costs:

In addition to the down payment, lenders may check if you have enough funds to cover closing costs (typically around 1.5% to 4% of the property price, depending on the province).

Liabilities and Spending Patterns:

Lenders may also review your regular account activity to see any recurring payments, liabilities (like car loans or credit cards), and whether you maintain a healthy balance in your account.

Details Required on the Bank Statement:

- Your Name and Account Number: The statement must clearly show that the account belongs to you.

- Dates: The statement should cover a period of at least 90 days.

- Deposits: The amount and source of all deposits during this period, particularly large ones, must be clear.

- Account Balance: The statement must show the current balance to confirm sufficient funds for the down payment.

Acceptable Sources of Down Payment:

Personal Savings: This is the most straightforward source of funds.

RRSP Withdrawal: First-time homebuyers can withdraw up to $60,000 from their RRSP under the Home Buyers’ Plan.

FHSA Withdrawal: First-time homebuyers can withdrawal, tax-free, on qualifying home purchases under the FHSA program.

TFSA Withdrawal: Withdrawals are made tax-free and without repayment obligations.

Gift from Immediate Family: Lenders only accept gifted down payments from direct family members (parents, siblings, grandparents, etc.).

Sale of Assets: If you’re using the proceeds from the sale of a car, investments, or other assets, documentation of the sale (e.g., bill of sale, investment liquidation statement) will be required.

Borrowed Down Payment: In some cases, you can borrow the down payment, but the lender must be aware, and the loan payments will be factored into your debt-to-income ratio.

Tips for Providing Bank Statements:

- Avoid Large Unexplained Deposits: If you do have a large deposit, provide a clear explanation (e.g., a bonus, gift, or sale of an asset) along with supporting documents.

- Ensure your Name, Account Number, and Financial Institution’s details are visible.

- Be Transparent: If there are any irregularities in your account history, be upfront and provide an explanation. Lenders may request further documentation if anything seems unclear.

What Happens if Funds Are Recently Transferred?

If you receive a large deposit into your account within 90 days of your application, you’ll need to show the source of the funds. This could be:

- A sale of assets (you’ll need the sale documentation).

- Gifted funds (you’ll need not only the gift letter but possibly documentation of the transfer).

- Savings from another account (you may need to provide statements from the other account as well).

Additional Documents for Down Payment Verification:

Investment Account Statements: If you are using funds from an investment account (stocks, mutual funds, etc.), you’ll need to provide statements from that account.

RRSP, FHSA, or TFSA Withdrawals: If you’re using funds from an RRSP (under the Home Buyers’ Plan), FHSA, and/or a TFSA you’ll need documentation showing the withdrawal(s).

By providing accurate and thorough documentation, you’ll help streamline the mortgage approval process. A mortgage broker can guide you on exactly what the lender requires and how to best present your financial situation.

Gifting Letter

A gift letter for a mortgage down payment is a document that confirms that the funds being used for a down payment are a gift and not a loan. This is important because lenders need to ensure that the borrower is not incurring additional debt that would impact their ability to repay the mortgage. The gift letter must confirm that the funds are a gift and not expected to be repaid.

Key Elements of a Gift Letter:

Donor and Recipient Information:

- Full name of the person giving the gift (the donor).

- Full name of the person receiving the gift (the borrower).

Relationship to Borrower:

- The letter must specify the relationship between the donor and the borrower.

- Lenders only accept gifts from immediate family members (parents, siblings, grandparents, etc.).

Gift Amount: The exact amount of money being gifted for the down payment.

Confirmation of Gift: A clear statement confirming that the money is a gift and does not need to be repaid. This assures the lender that the borrower is not taking on additional financial obligations.

Date of Transfer: The date when the gifted funds will be or have been transferred to the borrower’s account.

Signature: The gift letter must be signed by both the donor and the borrower.

Sample Gift Letter Format:

Here’s a basic example of what a gift letter might look like, but most lenders will provide you with a set copy:

Date: [Insert Date]

To Whom It May Concern,

I, [Donor’s Full Name], confirm that I am gifting the sum of [Insert Dollar Amount] to [Borrower’s Full Name] for the purpose of a down payment on the purchase of a home at [Property Address, if known]. I am [relationship to borrower (e.g., parent, grandparent, sibling)] of the recipient.

This gift is non-repayable, and there is no expectation or requirement of repayment. These funds are being provided to assist with the down payment for their mortgage.

The gifted funds will be transferred to [Borrower’s Name] on [Date of Transfer].

Sincerely,

[Donor’s Signature]

[Borrower’s Signature]

Additional Considerations:

Proof of Gifted Funds: In addition to the gift letter, lenders may ask for proof of the transfer of funds. This can include bank statements from both the donor and the borrower showing the transfer of money.

Immediate Family Requirement: Lenders only accept down payment gifts from immediate family members (parents, siblings, grandparents). Some lenders may have specific rules, so it’s important to confirm with your mortgage broker.

Non-Repayable Requirement: The lender must be certain that the gifted funds are not a loan that would add to the borrower’s debt load. This is why the non-repayable statement in the letter is crucial.

Timing of Funds: Lenders generally prefer that the funds be in the borrower’s account well in advance of the closing date. Make sure the transfer happens early enough to avoid delays.

Mortgage Gift Letter Has An Expiry: Gift letters come with an expiration date. Since financial institutions typically require down payment funds to be in your account for at least 90 days, this is the standard time during which you must close on the home.

Why Lenders Require a Gift Letter: Confirm No Additional Debt: A gift letter assures the lender that the down payment is coming from a legitimate source and will not add to the borrower’s debt load, which could affect their ability to pay the mortgage.

Comply with Mortgage Regulations: Lenders are required to comply with anti-money laundering laws and other financial regulations, so they need clear documentation of the source of funds for the down payment.

Verify Stability of Funds: The gift letter helps lenders confirm that the borrower has access to stable funds for the down payment without financial strings attached.

When is a Gift Letter Needed?

When part or all of the down payment is being gifted by a family member, rather than coming from the borrower’s own savings.

In situations where the borrower is using funds from a First Home Savings Account (FHSA)or government programs, a gift letter may still be required to show that the additional down payment funds are being gifted.

Down Payment Requirements:

In Canada, the minimum down payment required depends on the purchase price of the home:

- 5% for homes priced up to $500,000.

- 10% for the portion of the price between $500,000 and $1,499,000.

- 20% for homes priced $1,500,000 or more.

Gifted down payments are commonly used to help meet these requirements, especially for first-time homebuyers.

Conclusion:

A gift letter is a straightforward document, but it’s an important part of the mortgage application process if you’re using gifted funds for a down payment. It ensures the lender that the gift is not a loan and does not need to be repaid, which can affect mortgage qualification. Speak with your mortgage broker early so that they can obtain the lender’s required letter. Make sure to follow the lender’s requirements and provide all necessary documentation to avoid any delays.

Mortgage Closing Costs

When purchasing a home, mortgage closing costs are the final set of expenses that need to be settled before the transaction can be completed. They are in addition to your down payment and are essential for securing the property and mortgage. Closing costs typically range from 1.5% to 4% of the purchase price of the home, depending on the province and specific circumstances. Here’s a comprehensive guide on what to expect:

Key Mortgage Closing Costs:

Land Transfer Tax (LTT):

What it is: A tax paid to the provincial or municipal government upon transferring ownership of the property.

How much: The amount depends on the property’s purchase price and the province or municipality. Some cities have an additional municipal land transfer tax.

First-Time Homebuyer Rebates: Some provinces offer rebates for first-time homebuyers to reduce this cost.

Legal Fees and Disbursements:

What it is: You’ll need to hire a real estate lawyer, or notary, to handle the legal aspects of the purchase, including title search, preparing documents, and registration of the property transfer.

How much: Legal fees typically range from $1,000 to $2,500.

Disbursements: These are additional out-of-pocket expenses your lawyer incurs on your behalf (e.g., title searches, registration fees).

Title Insurance:

What it is: Title insurance protects the homeowner and lender against issues related to the property’s ownership, such as title defects, unpaid taxes, or zoning violations.

Is it mandatory: No, unless mandated by the lender.

How much: Usually costs between $200 and $400, depending on the property and lender requirements.

Property Insurance:

What it is: Home insurance is required by lenders to protect your home against fire, theft, and other damages. You’ll need to provide proof of insurance before closing.

How much: The cost varies based on the value of the home, location, and coverage, typically ranging from $500 to $2,500 annually.

Property Tax Adjustments:

What it is: If the seller has prepaid property taxes for the year, you will need to reimburse them for the portion covering the time after you take possession.

How much: The amount depends on when you purchase the home and the amount of taxes already paid.

Mortgage Default Insurance (CMHC/Genworth/Sagen Insurance):

What it is: If your down payment is less than 20%, you’ll be required to purchase mortgage default insurance to protect the lender in case you default on the loan. This can be added to your mortgage payments or paid as a lump sum at closing.

How much: Premiums range from 2.8% to 4% of the mortgage amount, depending on the size of the down payment.

Appraisal Fee:

What it is: Some lenders may require an appraisal of the property to determine its market value before issuing a mortgage.

How much: Typically between $400 and $600, though some lenders cover this cost.

Home Inspection Fee:

What it is: It’s highly recommended to get a home inspection to identify any potential issues with the property before purchase.

How much: Generally costs between $300 and $600, depending on the size and location of the home.

Interest Adjustment:

What it is: You may need to pay an interest adjustment if your first mortgage payment does not coincide with the closing date. This covers interest from the date of closing to the date of your first mortgage payment.

How much: The amount depends on the size of the mortgage and the timing of your payment schedule.

Prepaid Utilities or Condo Fees:

What it is: If the seller has prepaid utilities, condo fees, or other costs, you may need to reimburse them for the portion that covers your ownership period.

How much: Varies depending on the utility bills, condo fees, or other prepayments made by the seller.

Moving Costs:

What it is: While not a formal closing cost, don’t forget to budget for moving expenses, such as hiring a moving company or renting a truck.

How much: Typically ranges from $500 to $2,000, depending on the distance and services required.

First-Time Home Buyer Incentives:

If you’re a first-time homebuyer, there are several programs and incentives available that may help reduce your closing costs:

– RRSP Home Buyers’ Plan (HBP): Allows you to withdraw up to $60,000 from your RRSP (Registered Retirement Savings Plan) tax-free to use as a down payment.

– First Home Savings Account (FHSA): If you meet qualifying withdrawal conditions, monies may be used towards the purchase of my home and be tax-free (conditions apply).

– First-Time Home Buyers’ Tax Credit (HBTC): A tax credit worth up to $1,500 that can help offset some of the closing costs associated with buying your first home.

– Land Transfer Tax Rebate: Some provinces and cities offer a rebate on the land transfer tax for first-time homebuyers

Tips for Managing Closing Costs:

- Budget Ahead: Since closing costs typically range from 1.5% to 4% of the home’s purchase price, it’s crucial to budget for them in advance to avoid surprises.

- Use a Mortgage Broker: A mortgage broker can guide you through the process and help you understand how much you need to set aside for closing costs.

- Get Accurate Estimates: Ask your lawyer or notary for an estimate of the legal fees, title insurance, and other costs specific to your situation.

- Check for First-Time Buyer Programs: If you’re a first-time buyer, make sure to explore all available rebates and credits to reduce your overall closing costs.

Conclusion:

Closing costs are an essential part of the home-buying process. By understanding what’s involved and planning for these expenses in advance, you can avoid last-minute surprises and ensure a smoother home purchase. It’s important to save enough to cover these costs in addition to your down payment, and working with professionals like real estate lawyers and mortgage brokers can help you navigate the process efficiently.

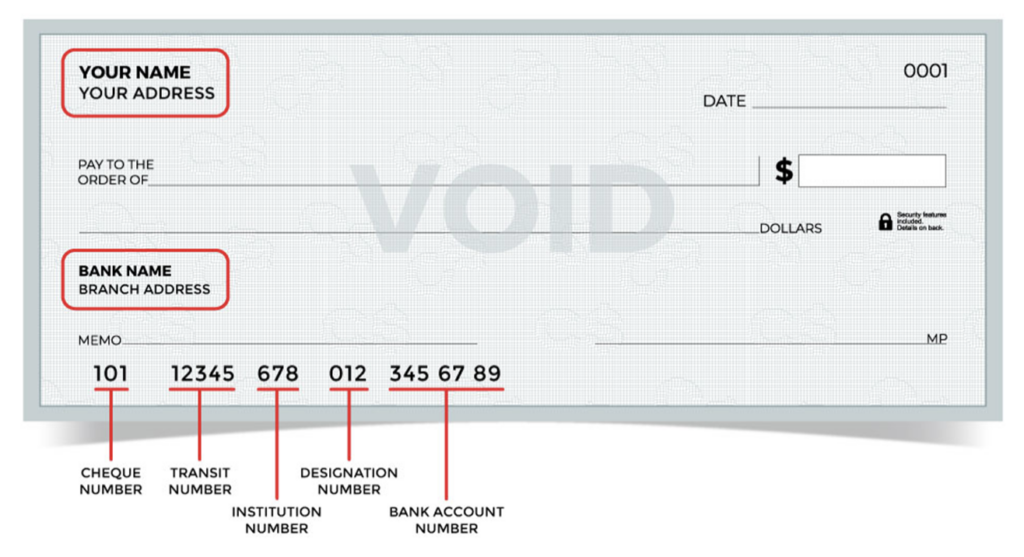

Void Cheque

When applying for a mortgage, lenders or mortgage providers may request a void cheque for various reasons, primarily for setting up automatic mortgage payments. A void cheque contains your bank account information, which allows the lender to automatically withdraw mortgage payments from your account.

Here’s a breakdown of why void cheques are used and how they fit into the mortgage process:

What is a Void Cheque?

A void cheque is a regular cheque that has the word “VOID” written across it. This disables the cheque from being cashed but keeps the key information visible. The void cheque provides important details like:

- Bank Name and Branch

- Transit Number

- Institution Number

- Account Number

Why Do Lenders Request a Void Cheque for Mortgages?

Setting Up Automatic Payments: Lenders require a void cheque to set up Pre-Authorized Debit (PAD) payments, where mortgage payments are automatically withdrawn from your bank account on a specified date each month. This is the most common way to ensure timely payments.

Direct Deposit or Withdrawal Information: The cheque provides the necessary bank account information (account number, transit number, and financial institution number) required to link your mortgage account with your bank.

Account Verification: Some lenders may ask for a void cheque to ensure that the account you’re providing is active and belongs to you. It’s a simple way to verify your account information and avoid any mistakes in setting up the withdrawals.

When Will You Need to Provide a Void Cheque?

At Closing: Once your mortgage is approved and the closing date is approaching, the lender will likely ask for a void cheque to ensure that your mortgage payments can be automatically withdrawn.

Changing Bank Accounts: If you switch bank accounts during the mortgage term, you may need to provide a new void cheque to update the withdrawal information.

How to Obtain and Provide a Void Cheque:

From Your Chequebook: Simply take a blank cheque from your chequebook and write “VOID” in large letters across the front. Do not sign the cheque. Scanned and uploaded/emailed copies of physical Void cheques are acceptable by most lenders.

Online Banking (Digital Void Cheque): Most banks offer the option to generate a digital void cheque online. Log into your online banking account, navigate to your chequing account, and look for an option like “Direct Deposit Information” or “Download Void Cheque.” You can download or print a PDF version of the void cheque.

Other Alternatives to Void Cheques:

If you don’t have access to a void cheque or chequebook, most lenders will accept the following alternatives:

Direct Deposit Form: This can be obtained from your bank and includes the same banking details required for withdrawals.

Pre-Authorized Debit (PAD) Form: Some lenders provide a form that allows you to input your banking details directly for setting up payments.

Online Banking Printout: A printout from your online banking showing your account details may sometimes be accepted, but you should verify this with your lender.

Speak with your mortgage broker to confirm your lender’s preferred alternative.

Common Issues to Avoid:

Incorrect Bank Account Information: Ensure that all account numbers (transit number, financial institution number, and account number) are correct to avoid payment delays or misapplied payments.

Outdated Information: If your account information changes during your mortgage term, provide an updated void cheque as soon as possible to prevent missed payments.

Conclusion:

Providing a void cheque is a simple but important step in the mortgage process. It ensures that your lender has the correct banking information to set up automatic withdrawals for your mortgage payments, helping to avoid missed payments or complications. Whether you provide a physical void cheque or a digital version through online banking, this document ensures smooth and timely mortgage payments.

Here is an example of a VOID Cheque:

Other

Acceptable ID

When applying for a mortgage, lenders require 2 forms of ID to prove identity and confirm the applicant’s information. Here is a list of acceptable forms of identification commonly used in mortgage applications:

Primary Identification (must include photo, signature, be government-issued, and have an expiry date):

Canadian Passport

Driver’s License (issued by a Canadian province or territory)

Provincial ID card (in BC only, and must be a separate card from their driver’s licence)

Permanent Resident Card

Diplomatic identification issued by Foreign Affairs Canada

Firearms Licence (must be issued in Canada and include a photo)

Secure Certificate of Indian Status

Canadian Armed Forces Identification Card

NEXUS Card (for cross-border travel)

Secondary Identification (required in combination with a primary ID):

Social Insurance Number (SIN) card

Birth Certificate

Health Card (depending on the province, as some provinces restrict its use as ID)

Old Age Security Card

Credit Card or Bank Card (with name and signature)

Citizenship Certificate or Citizenship Card

Driver’s License from the County they reside in

Foreign Passport (if applying as a non-resident or new immigrant)

Lenders may have specific requirements, so it’s always a good idea to speak with your mortgage broker to confirm the acceptable documentation.

Bad Credit

Obtaining a mortgage with bad credit can be more challenging, but it is still possible. Here’s what you need to know if you have poor credit and are considering buying a home or refinancing a mortgage:

1. Impact of Credit Score

Credit Scores: In Canada, credit scores range from 300 to 900. A score below 600 is generally considered poor by most lenders. With a lower score, you may face higher interest rates, stricter terms, or fewer lender options.

Prime vs. Subprime Lenders:

Prime Lenders (big banks, credit unions) typically require good-to-excellent credit for the best rates.

Subprime Lenders or alternative lenders (private lenders, etc) cater to those with less than ideal credit. However, their rates tend to be higher, and the terms may be more restrictive.

2. Down Payment Requirements

Higher Down Payments: You may be required to put down a larger down payment. For those with good credit, a down payment of 5% is typical for homes under $500,000. Whereas, lenders might ask for a 20-35% down payment to mitigate their risk for those with poor credit

Loan-to-Value (LTV) Ratio: Lenders may approve a lower LTV, meaning you can only borrow a smaller portion of the home’s value.

3. Mortgage Default Insurance

Mortgage Insurance (CMHC): If your down payment is less than 20%, you’ll need to pay for mortgage default insurance through the Canada Mortgage and Housing Corporation (CMHC), Sagen (formerly Genworth), or Canada Guaranty. However, these insurers may reject applications with bad credit, limiting your options.

No Mortgage Insurance: If you have a 20% or greater down payment, you can avoid mortgage insurance. Some alternative lenders may allow this but will charge higher interest rates to offset the risk.

4. Interest Rates

Higher Interest Rates: Lenders see those with lower credit scores as higher-risk borrowers, which often translates into higher mortgage interest rates. The difference in rates can be significant, leading to higher monthly payments and greater overall interest paid over the mortgage’s lifetime.

Fixed vs. Variable Rates: Most subprime lenders offer fixed-rate mortgages to ensure they mitigate risk with predictable payments.

5. Types of Lenders

A Lenders: These are traditional lenders like big banks and credit unions. They prefer borrowers with strong credit scores, stable incomes, and low debt levels.

B Lenders: These are alternative lenders who offer mortgages to individuals with lower credit scores or non-traditional income sources. While their rates are higher, they are more flexible with credit issues.

Private Lenders: Private lenders often have the least stringent requirements but charge the highest rates. They may also require more collateral or offer shorter mortgage terms.

6. Mortgage Brokers

Specialized Brokers: Mortgage brokers can be valuable when you have bad credit because they have access to a wide range of lenders, including those that specialize in subprime mortgages. They can help you find the best terms available for your situation.

Be Cautious: Some brokers may charge higher fees or push unfavourable products. Ensure the broker is reputable and transparent about all fees and conditions.

7. Debt-to-Income Ratio (DTI)

Income Matters More: When you have bad credit, lenders place more emphasis on your income and ability to repay the loan. Your debt-to-income ratio (DTI)—the percentage of your income that goes toward paying debts—will be scrutinized. A lower DTI (typically under 40%) improves your chances of approval.

Stable Employment: Having a stable source of income can help offset a low credit score in the eyes of lenders. Lenders want to see consistent, verifiable income, especially if you have a poor credit history.

8. Improving Your Credit Score

Boosting Your Score: Working to improve your credit score will save you money. Ways to improve your score include:

Paying down credit card balances.

Making all payments on time.

Avoiding new credit inquiries.

Reducing overall debt.

Credit Repair: Sometimes, you can fix errors on your credit report. Get a copy of your credit report from TransUnion or Equifax and check for inaccuracies.

9. Co-Signers

Using a Co-Signer: If you have bad credit, using a co-signer with good credit can improve your chances of getting a mortgage with more favourable terms. The co-signer becomes responsible for the mortgage if you default, so this is a big commitment for them.

Requirements: The co-signer must meet the lender’s credit and income requirements. Co-signing can be risky for the co-signer, as it affects their credit and borrowing capacity.

10. Mortgage Options for Bad Credit

Bad Credit Mortgage: Some lenders specifically offer “bad credit mortgages.” These mortgages have stricter terms, such as higher interest rates and fees, but can help you secure financing.

Second Mortgage: If you already own a home, taking out a second mortgage may be an option to consolidate debt or access home equity. These loans also come with higher rates.

Rent-to-Own: For those unable to qualify for a mortgage right away, a rent-to-own arrangement allows you to rent a home with an option to buy it later. This can give you time to improve your credit while building equity in the property.

11. Alternative Mortgage Solutions

Shorter Mortgage Terms: Some subprime lenders may offer shorter terms (e.g., 1-2 years) with higher interest rates, allowing you to refinance once your credit improves.

Home Equity Line of Credit (HELOC): If you already own a home and have equity, you might be able to use a HELOC to consolidate debt, which can help improve your credit over time.

12. Mortgage Stress Test

Qualifying with Bad Credit: You must pass the mortgage stress test, even with bad credit. The stress test ensures that you can afford the mortgage if interest rates rise. Lenders will evaluate your ability to pay at the higher of either the Bank of Canada’s qualifying rate or 2% above the rate offered.

13. Beware of Predatory Lending

High Fees and Penalties: Some lenders that target those with bad credit may impose high fees, hidden charges, or severe penalties for missed payments. Always read the fine print carefully.

Watch for Scams: Be cautious of lenders or brokers who ask for upfront fees or guarantee approval without verifying your financial situation. Legitimate lenders don’t guarantee mortgages without proper checks.

14. Refinancing Options for Bad Credit

Equity-Based Refinancing: If you already have a mortgage but have bad credit, refinancing can be difficult unless you have significant equity in your home. Lenders may focus more on the property’s value than your credit score in such cases.

Higher Rates for Refinancing: You may face higher interest rates when refinancing with bad credit, but this option can still help if you need to consolidate high-interest debt.

15. Long-Term Financial Planning

Consider the Long-Term Costs: Higher interest rates mean paying more in interest over the life of the mortgage. Make sure you can afford the higher payments and factor in how long it will take you to pay off the mortgage.

Plan to Refinance: If you do obtain a mortgage with bad credit, plan to refinance once your credit improves. Refinancing to a lower rate in the future can save you significant amounts of money.

Final Thoughts:

While getting a mortgage with bad credit is possible, it often comes with higher costs and risks. It’s important to carefully weigh your options, improve your credit where possible, and work with a reputable mortgage broker. Patience and preparation can help you secure better terms over time.

Condo Insurance

Proof of condo insurance is often required by mortgage lenders before approving or finalizing a mortgage for a condo/townhouse purchase. Condo insurance ensures that both the lender’s investment and the borrower’s property are protected in case of damage or loss. Here’s how this works:

1. Types of Insurance Required for Condos

Personal Condo Insurance (Unit Insurance): This covers the interior of your unit (walls, flooring, appliances, fixtures) and personal belongings, as well as liability coverage for injuries inside your unit.

Condo Corporation Insurance: The condo corporation has a separate insurance policy that covers the building’s structure, common areas (like elevators, hallways, and lobbies), and exterior. However, this does not cover the individual units or personal property within them.

2. Why Lenders Require Proof of Condo Insurance

Mortgage lenders require proof of personal condo insurance to ensure that the borrower’s investment is protected in case of unforeseen damage (like fire or water damage) that could affect the condo unit.

Lenders want to make sure that in the event of a loss, the borrower is not financially devastated, which could lead to default on the mortgage.

The insurance provides coverage for the lender’s collateral (the unit itself) if it’s damaged.

3. Proof of Condo Insurance Requirements

Before finalizing a mortgage, lenders typically ask for a certificate of insurance or policy declaration page from your insurance provider that shows the following:

The insurance policy number.

The name of the insurance provider.

The coverage amount (should be sufficient to cover the contents and improvements within your condo).

The effective and expiry dates of the insurance policy.

Confirmation that liability coverage is included.

In some cases, lenders may ask to be listed as the “loss payee” on your policy. This means that in the event of significant damage to the unit, the insurance company would notify the lender or pay them directly to cover any losses tied to the mortgage.

4. Condo Corporation’s Insurance

While your personal condo insurance covers your unit, lenders will also want to confirm that the condo corporation’s master insurance policy is in place for the building and common areas. This ensures that the overall property (building) is adequately insured.

When buying a condor townhouse, you should request a status certificate from the condo corporation, which includes details about the building’s insurance coverage, among other important information about the condo’s financial health and rules.

Lenders may ask for confirmation from the condo corporation that they have an up-to-date insurance policy for the building. This is critical for both the lender and the buyer, as uninsured damage to the building could impact the value of your unit.

5. When is Proof of Condo Insurance Required?

Lenders will typically ask for proof of insurance before closing on the mortgage, but it may also be a condition of final mortgage approval. Without proof of adequate insurance, lenders may refuse to advance the funds.

In some cases, the lender may ask for proof of insurance shortly after closing, but it’s generally best to have the insurance in place well before the mortgage funds are disbursed.

6. What Happens if You Don’t Provide Proof of Condo Insurance?

If you fail to provide proof of condo insurance, lenders may delay the release of mortgage funds or make it a condition of your mortgage approval.

In extreme cases, if insurance isn’t maintained during the term of the mortgage, the lender may purchase force-placed insurance on your behalf, which tends to be more expensive and only covers the lender’s interests, not the borrower’s personal property or liability.

Having the right insurance in place is not only a lender requirement but also crucial for your own financial security.

Corporate Ownership

When a corporation applies for a mortgage, lenders typically require more documentation compared to an individual mortgage application. This is because corporate mortgages involve assessing both the corporation’s financial health and the personal guarantees of the business owners or directors, if applicable. Here’s a list of the typical documentation required when a corporation applies for a mortgage:

1. Corporate Documents

Lenders need to verify the legal status and structure of the corporation:

Certificate of Incorporation: A copy of the document that proves the company is legally registered in Canada.

Articles of Incorporation: Outlines the structure and purpose of the corporation.

Corporate Bylaws: These are the rules governing how the corporation operates.

Corporate Resolution to Borrow: A formal resolution by the board of directors authorizing the mortgage application and specifying which individuals have the authority to sign documents on behalf of the corporation.

2. Financial Documents

Lenders will closely examine the financial health of the corporation:

Financial Statements (last 2-3 years): Audited or reviewed statements, including income statements, balance sheets, and cash flow statements, showing the company’s profitability and stability.

Business Bank Statements (last 6-12 months): These help verify the corporation’s cash flow and liquidity.

Corporate Tax Returns (last 2-3 years): This helps lenders assess the corporation’s tax history and profitability.

Notice of Assessments (NOAs): These may be required to verify that the company has filed its taxes appropriately.

3. Personal Guarantees and Personal Financials

Even though the mortgage is under the corporation’s name, lenders often require personal guarantees from the directors or key shareholders, especially for smaller or privately held companies:

Personal Net Worth Statements: These outline the personal assets and liabilities of the business owners or guarantors.

Personal Tax Returns (last 2-3 years): Lenders may ask for the personal tax returns of the primary shareholders or directors, especially if they are providing personal guarantees.

Personal Credit Reports: Credit checks are usually performed on the directors or guarantors to assess their creditworthiness.

4. Corporate Ownership and Structure

Lenders need clarity on the ownership and control of the corporation:

Shareholder Register: A list of shareholders and their percentage of ownership in the company.

Director Information: Names, addresses, and positions of the directors and officers of the corporation.

Organizational Chart: For larger corporations, a chart showing the corporate structure, including subsidiaries or affiliated companies, may be required.

5. Business Plan or Purpose of Loan

Lenders may ask for a business plan or a detailed explanation of how the mortgage will be used. For example:

Business Plan: If the mortgage is being used for expansion or acquisition of new property, a business plan may be required to outline future projections and the purpose of the mortgage.

Property Details: Information about the property being purchased, including an appraisal or purchase agreement, zoning details, and any environmental reports if applicable.

6. Property-Related Documents

When a corporation is applying for a mortgage for a specific property, these additional documents are often required:

Purchase Agreement: If the property is being purchased, the agreement between the buyer (corporation) and the seller.

Property Appraisal: A professional appraisal of the property’s value, often required by the lender.

Environmental Assessment: For commercial properties or land, lenders may require environmental assessments to ensure the property is free from environmental liabilities (e.g., contamination).

Property Survey: A legal land survey to confirm property boundaries and identify any issues like easements or encroachments.

7. Lease Agreements (if applicable)

If the corporation is purchasing an income-producing property (e.g., commercial or multi-unit residential), copies of existing lease agreements and rent rolls may be required to assess potential rental income.

8. Insurance Documentation

Lenders will require proof of insurance to ensure the property is protected:

Proof of Property Insurance: Ensuring that the property is insured for its replacement value.

Liability Insurance: Depending on the type of property, the corporation may also need liability insurance.

9. Proof of Deposit or Down Payment

Lenders will require proof of the source of the down payment:

Corporate Bank Statements: Showing that the company has the required funds for the down payment.

Source of Funds: If the funds for the down payment come from a loan or a different source, the lender may ask for documentation on this source.

10. Additional Documents (as requested by lender)

Legal Opinion Letter: Some lenders may require a legal opinion from the corporation’s lawyer confirming the company’s ability to enter into the mortgage contract.

Corporate Tax Account Status: Proof that the corporation has no outstanding tax liabilities or is up to date on tax filings (sometimes referred to as a clearance certificate from the CRA).

Summary:

Corporate Legal Documents: Certificate of Incorporation, articles of incorporation, corporate resolution to borrow.

Financial Documents: Financial statements, corporate tax returns, business bank statements.

Personal Guarantees: Personal tax returns, credit checks, net worth statements for key shareholders or directors.

Property-Related Documents: Purchase agreements, property appraisal, environmental assessments, insurance proof.

Business Plan: If required, for explaining the loan purpose and projections.

Lenders want to ensure that both the corporation and the individuals involved are financially stable and capable of repaying the loan. Therefore, expect a comprehensive review of corporate and personal financials during the mortgage application process.

Renewal: Current Lender or Switch

When your mortgage is up for renewal, deciding whether to stay with your current lender or switch can have financial implications. Here are some factors to consider before making a decision:

1. Interest Rates

Current Lender: Your current lender will offer you a renewal rate, but it might not always be their best rate. Often, the initial offer can be negotiated.

Other Lenders: Other lenders might offer more competitive rates, especially if they are trying to attract new customers. Shopping around could save you money in the long run.

2. Mortgage Terms and Flexibility

Review the terms and conditions your current lender offers. Other lenders might provide more flexible prepayment options, better penalties for early payment, or different amortization periods that could suit your needs better.

3. Mortgage Type

If you are considering switching from a variable to a fixed-rate mortgage (or vice versa), this might be a good time to explore new options.

4. Fees for Switching

Switching lenders can involve fees like appraisal fees, discharge fees, or legal fees. Some lenders may offer to cover these costs if you move to them, but it’s important to calculate whether these costs outweigh the potential savings from a lower interest rate.

5. Relationship with Current Lender

If you’ve had a positive experience with your current lender, they may be willing to negotiate better terms to retain you as a customer. Loyalty and a good track record could give you leverage in negotiating a better deal.

6. Convenience

Staying with your current lender can be more convenient, as switching involves paperwork and time. However, if the savings from switching are significant, this effort could be worthwhile.

7. Credit Score

Your credit score might impact the offers you receive from other lenders. A higher credit score can often lead to better mortgage terms, so be sure to check your score before shopping around.

Next Steps:

Negotiate with your current lender to see if they can offer you a better rate or more favourable terms.

Shop around for rates from other lenders or consult a mortgage broker to explore your options.

Would you like help comparing some offers or going through your options in more detail? A mortgage broker can help provide a full picture of your options, so that you can secure the right product with the right lender.

Debt to Income

The debt-to-income (DTI) ratio is a critical tool that lenders use to evaluate mortgage applicants. The DTI ratio helps lenders determine whether a borrower has the financial capacity to manage a mortgage on top of existing debts. There are two main ratios that Canadian lenders analyze:

Gross Debt Service (GDS) Ratio: This ratio focuses specifically on housing-related expenses and is calculated as the percentage of a borrower’s gross monthly income that goes toward housing costs. These costs include:

Principal and interest on the mortgage

Property taxes

Heating costs

50% of condo fees (if applicable)

Lenders typically require the GDS ratio to be 39% or less. If it exceeds this limit, the borrower might be seen as financially overstretched, increasing the risk of default.

Total Debt Service (TDS) Ratio: This ratio includes all monthly debt obligations, not just housing-related expenses. It considers:

Mortgage payments (principal and interest)

Property taxes, heating, and condo fees (like the GDS ratio)

Monthly debt payments, such as credit cards, car loans, student loans, and any other debt

The TDS ratio must generally not exceed 44% of the borrower’s gross monthly income. This ratio gives lenders a broader perspective on the borrower’s total debt load.

How These Ratios Affect Mortgage Approval

Qualification Limits: Canadian lenders use GDS and TDS as hard limits for mortgage qualification. If either ratio is too high, the borrower may need to consider a smaller mortgage amount, a larger down payment, or pay down other debts to reduce monthly obligations.

Impact of the Mortgage Stress Test: In addition to meeting GDS and TDS requirements, applicants must pass a “mortgage stress test.” Lenders calculate the ratios based on either the current mortgage rate + 2% or the Bank of Canada’s qualifying rate, whichever is higher. This test ensures that borrowers can afford payments even if interest rates rise.

By managing DTI, lenders aim to protect both the borrower and the financial system, preventing borrowers from taking on mortgages they may not be able to sustain, especially in an economy where interest rates and housing costs can fluctuate.

Default

When you default on your mortgage it means you’ve failed to meet the terms of your mortgage agreement, typically by missing one or more mortgage payments. The consequences of defaulting can escalate over time, leading to serious financial and legal repercussions, including foreclosure. Here’s a breakdown of what happens when you default on your mortgage:

1. What Constitutes a Default?

Mortgage default can occur for several reasons, including:

Missing mortgage payments (this is the most common form of default).

Failing to maintain property insurance.

Failure to pay property taxes.

Breaching other terms of the mortgage contract, such as not maintaining the home in good condition or committing fraud.

2. Consequences of Default

Late Payment Fees: Initially, you’ll incur late fees if you miss a payment. These vary depending on the lender and how many days late the payment is.

Negative Impact on Credit Score: Missed or late payments will be reported to credit bureaus, which can significantly lower your credit score, making it more difficult to qualify for loans in the future.

Increased Debt: If you continue to miss payments, interest and penalties will accumulate, adding to your overall debt and making it harder to catch up.

3. Grace Period and Options for Arrears

Many lenders offer a grace period before taking serious action, giving borrowers the chance to bring their mortgage payments up to date (also known as “curing” the default). During this time:

Communication with the lender is key. If you experience financial difficulties, contact your lender as soon as possible to discuss options, which could include:

Payment deferral (temporarily postponing payments).

Loan modification (adjusting the loan terms to make payments more affordable).

Special payment arrangements to help you catch up on missed payments.

4. Legal Action After Default

If you fail to bring your payments up to date after the grace period, your lender may take legal action. This can vary depending on the province you live in, as mortgage laws differ across Canada. Generally, the lender will pursue one of the following legal processes:

A. Power of Sale (Most Common in Ontario and Other Provinces)

Power of Sale is the most common legal remedy used by lenders in Ontario and several other provinces (such as New Brunswick, Prince Edward Island, and Newfoundland and Labrador). Under a Power of Sale, the lender has the legal right to sell the property to recover the mortgage balance owed without going through a lengthy court process.

Process of Power of Sale:

The lender must give you notice (typically 15-35 days depending on the province) to allow you time to pay the arrears or the full balance of the mortgage.

If you do not pay, the lender can list the property for sale.

The sale proceeds are used to pay off the outstanding mortgage debt, legal fees, and other associated costs. Any remaining funds are returned to the borrower (homeowner).

Key Point: In a Power of Sale, the lender doesn’t take ownership of the property—they simply sell it on the open market to recover what’s owed.

B. Foreclosure (Most Common in Western Canada)

Foreclosure is a more severe legal process where the lender takes ownership of the property, rather than selling it on your behalf. This is more common in provinces like British Columbia, Alberta, and Manitoba.

Process of Foreclosure:

The lender must first file a foreclosure lawsuit in court.

A redemption period may be granted by the court (usually between 30 to 180 days), giving you the chance to catch up on missed payments.

If you are unable to bring the mortgage up to date, the court may issue a foreclosure order, allowing the lender to take ownership of the property.

In most cases, once the property is sold (either through a court-ordered sale or auction), any shortfall between the sale price and the mortgage balance can still be pursued by the lender as a deficiency judgment.

Key Point: In foreclosure, you lose ownership of the property, and the lender may not be required to give you any remaining funds after the sale, especially if the sale price does not cover the outstanding debt.

C. Judicial Sale (Used in Some Provinces)

In some provinces, a judicial sale is used as an alternative to foreclosure. This process involves the lender applying to the court for permission to sell the property, under court supervision.

The court oversees the sale to ensure the property is sold for fair market value, and the proceeds are distributed accordingly.

5. Deficiency Judgment

In some cases, if the proceeds from the sale of the home (whether through Power of Sale or foreclosure) are not enough to cover the outstanding mortgage balance, the lender may seek a deficiency judgment. This means the borrower will be held liable for the difference between the sale price and the mortgage debt.