What Sets Me Apart

What sets me apart from other mortgage brokers comes from a combination of my personal approach, specialization, service offerings, and the value I add to clients. Here are some areas that distinguish myself:

Personalized Client Service

Tailored Solutions: I focus on providing highly personalized mortgage advice, spending more time understanding your unique needs and financial goals. By offering customized mortgage solutions, I make sure you feel valued and understood.

Client Education: Educating clients about the mortgage process empowers them to make informed decisions. I takes time to explain complex terms or concepts clearly, so that you know exactly where you are every step of the way.

Proactive Communication: I provide timely and proactive updates throughout the mortgage process, as well as being easily accessible if questions or concerns arise.

Specialization in Niche Markets

First-Time Homebuyers: I help first-time homebuyers navigate the complexities of getting a mortgage, including qualifying for special programs and incentives.

Self-Employed or Non-Traditional Borrowers: I specializing in clients with non-traditional income (e.g., self-employed or seasonal/part-time workers) or those who have difficulty qualifying with traditional lenders.

Alternative Lending Solutions: I work with alternative lenders (B-lenders, private lenders) to support clients with lower credit scores or unique financial situations.

Exceptional Market Knowledge

Local Market Expertise: I have deep knowledge of the local real estate market, can provide insights into neighbourhoods, property values, and economic trends that others may overlook.

Rate Negotiation Skills: I am an expert negotiator who consistently gets clients the best rates. I will continue to negotiate on your behalf up until your mortgage closes, meaning I will fight for the best rate for you!

Exclusive Relationships with Lenders

Access to Exclusive Mortgage Products: With established strong relationships with lenders, I have access to exclusive deals or rates, providing my clients access to options that aren’t widely available elsewhere.

Customized Solutions from Lenders: I will negotiate unique mortgage features, like extended amortizations or flexible prepayment options, for clients with specific financial needs.

Exceptional After-Sales Service

Ongoing Support: I provide ongoing financial reviews and mortgage check-ins, even after the mortgage is secured, as I am committed to making sure you are in the right product at the right time.

Holistic Financial Advice: I offer advice and solutions that extends beyond just mortgages—such as debt consolidation, investment opportunities, or home buying strategies—offering more comprehensive support.

Technology and Efficiency

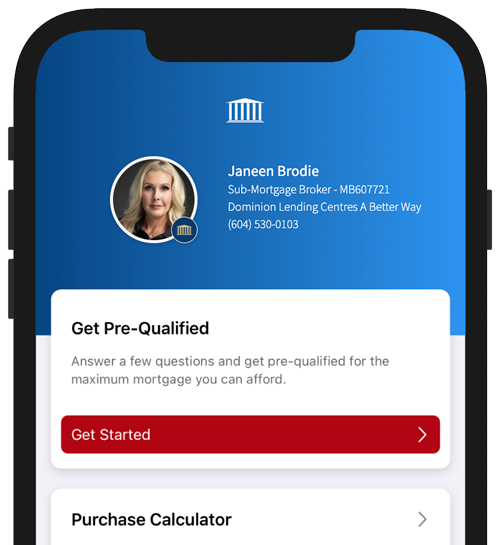

Streamlined Processes: I leverage state of the art technology (like online applications, quick pre-approvals, and digital document sharing) to make the mortgage process faster and more convenient, appealing to busy clients who value efficiency.

Digital Communication: I utilizing secure platforms for communication and virtual meetings for my tech-savvy clients who appreciate modern convenience.

Transparency and Trust

No Surprises Approach: I providing honest, upfront information without hidden fees or unexpected costs. Transparency is key in building our long-term relationship.

Client Testimonials and Referrals: A proven track record backed by positive client reviews and strong referral networks speaks to the trust I build with clients.

Client Relationship Focus

Building Long-Term Relationships: Instead of just aiming for a transaction, I focus on creating long-term relationships, making clients feel like they have a financial partner for life.

Community Involvement: Being active in my community, participating in local events, and providing educational material, so that one is armed with knowledge, are passions of mine.

Problem-Solving Abilities

Solving Tough Cases: My professionalism and knowledge to solve complex or challenging mortgage cases (such as those involving poor credit, legal complications, or urgent financing needs), differentiates me from other brokers; I am honoured to be trusted with my client’s difficult scenarios.

Creative Financing Solutions: I structure deals creatively to help clients achieve their homeownership goals (e.g., securing a mortgage with unconventional conditions).

Strong Ethical Reputation

Client-First Approach: Having a reputation for always acting in the best interests of my clients (rather than being swayed by commissions) is the upmost importance to me. You deserve an ethical, trustworthy mortgage broker.

Client Relationship Focus

Building Long-Term Relationships: Instead of just aiming for a transaction, I focus on creating long-term relationships, making clients feel like they have a financial partner for life.

Community Involvement: Being active in my community, participating in local events, and providing educational material, so that one is armed with knowledge, are passions of mine.

Problem-Solving Abilities

Solving Tough Cases: My professionalism and knowledge to solve complex or challenging mortgage cases (such as those involving poor credit, legal complications, or urgent financing needs), differentiates me from other brokers; I am honoured to be trusted with my client’s difficult scenarios.

Creative Financing Solutions: I structure deals creatively to help clients achieve their homeownership goals (e.g., securing a mortgage with unconventional conditions).

Strong Ethical Reputation

Client-First Approach: Having a reputation for always acting in the best interests of my clients (rather than being swayed by commissions) is the upmost importance to me. You deserve an ethical, trustworthy mortgage broker.