First Time Home Buyer

As a First-time homebuyers several key considerations can influence your decisions when entering the housing market.

Affordability and Budgeting

Down Payment: In Canada, a minimum down payment of 5% is required for homes priced under $500,000. For homes priced between $500,000 and $1,499,999 buyers must make a down payment of 5% on the first $500,000 and 10% on the portion above that. Homes over $1.5 million require a 20% down payment.

Closing Costs: These include legal fees, land transfer taxes, home inspection fees, and other associated expenses, often amounting to 1.5%-4% of the home’s purchase price.

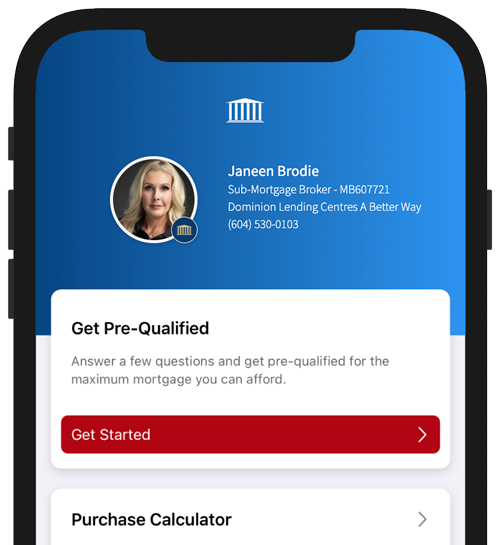

Monthly Mortgage Payments: It’s crucial to ensure mortgage payments fit within the buyer’s budget. Tools like mortgage calculators can help.

Mortgage Options and Pre-Approval

Fixed vs. Variable Rates: First-time buyers need to decide whether they want the stability of fixed mortgage rates or potentially lower (but fluctuating) rates with a variable mortgage.

Mortgage Pre-Approval: This process provides an idea of how much a buyer can borrow and locks in a rate for a certain period. It also strengthens offers when competing for a home.

Government Incentives and Programs

Home Buyers’ Plan (HBP): This allows first-time homebuyers to withdraw up to $60,000 from their RRSPs (Registered Retirement Savings Plans) to purchase or build a home.

First Home Savings Account (FHSA): A Canadian tax-free savings account designed specifically to help first-time homebuyers save for their first home.

First-Time Home Buyers’ Tax Credit: A non-refundable tax credit that provides first-time homebuyers with some tax relief (up to $1,500 as of 2023).

Long-Term Considerations

Future Growth: First-time buyers should consider how long they plan to stay in the home and their future needs (such as family growth). It’s also important to assess potential property appreciation over time.

Maintenance and Additional Costs: Property taxes, insurance, utilities, and maintenance can add up, so first-time buyers should factor in these long-term costs.

Understanding these factors helps first-time homebuyers make more informed and confident decisions when entering the real estate market.